Our Guest Mentor:

QUIN SQ THONG is a Chartered Accountant who works for a public listed corporation by day and runs a social enterprise by night. In the day time, Quin works with and trains investment bankers, compliance officers, accountants, lawyers, the smartest of the smart. After work, she works with illiterate village housewives from the Kingdom of Bhutan to build a thriving little business together – a little venture that won hearts and thankfully won awards from FedEx and DBS Bank, National University of Singapore.

Quin is passionate about empowering young talents and women from all backgrounds, especially in the areas of financial literacy. In 2016, she co-authored a children’s book on wealth management, published by Oxford University Press, which aims to teach children that wealth is more than money. It includes time, knowledge, relationship and more.

Quin holds FCCA, ACA & CPA designations, has an MBA from the Australian Graduate School of Management and is currently based out of London, England.

Key Quotes from the Episode:

[On expanding skillsets] “I made sure that I have to expand my skillset. It’s not just being good at tax, at finance, at debit and credit, but presentation skills, for example. You’re not only present to your own people, your own company, but you present to the board, you present to your clients. You are part of a pitching team and you’ve got to look and act the part.” [06:15]

[On presentation skills] “when the day you can present without a PowerPoint and then you put blank slides in, that’s when you are good presenter. As long as you need your PowerPoint, you’re not as good.” [10:48]

[On the finance role] “I see the power of information at their hands. Do not disregard that it’s so powerful and the power that lies in us when we can help make better decisions together with the board or department heads, or whoever are in your team to help you make better decisions for the company. So as long as we continue in this role using finance and numbers, I feel that the world is our oyster. You can go into any role you want in the company.” [14:40]

[On being in a leadership role] “People want to come and talk to you. So the point is that we have to be there for them. And what I found that you also give them a framework, so they just don’t come to your office and then we’ll come out with everything and then you go and pick things. No. It was too hard. So you also coach them, you give them a framework like the way, accountants, if you have an investment, I give you an investment appraisal template, you fill it out. We don’t have to do that, but really when they come, they know that they can tell me the problem.” [20:14]

[On becoming managing director] “At the MD level, it’s not about you being the top accountant and top salesman. You are, how do you call it, Mr. Everybody, or Ms. Everybody. So for you is how do you engage and connect with everyone? And that needs communication skills, listening skills, different skillsets that probably some accountants may not have, but have to acquire on the way.” [23:32]

[On learning] “Please ask the question. Because when you don’t know, you don’t know. That’s where the danger is when you know you don’t know. Just ask.” [32:08]

[On outsourcing] “But at the same time when that person does it, I’m freed up to do other things that I’m better at. And not only do I get freedom of time to do what I like, but perhaps I’ve got more mind space to think about what I need to think about.” [34:55]

Key Points from the Episode:

- What we mean by strategic learning and the importance of expanding our skillsets as accountants

- How to transition from a finance role into a company leadership role

- How to leverage your finance skills into building social enterprises

- The importance of frameworks in helping accomplish goals in your current role and beyond

Stamped Show Notes

[03:27] Quin shares how she went from being an accountant to the extraordinary career she has now.

[08:23] Quin talks about how she came to realize that she needed to expand her skillsets and what she started doing differently that allowed her to be open to learning new skills.

[08:18] Quin gives advice for those looking to move from a finance role or moving between continents.

[22:51] Quin explains further what strategic learning means.

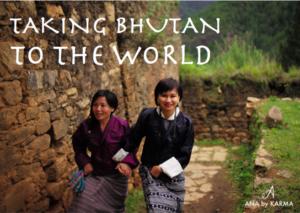

[25:36] Quin tells us about her social enterprise work in Bhutan with Ana by Karma and shows us what we can achieve outside our roles.

[33: 19] Quin shares with us the best bit of advice she has received.

[38:15] A book recommended by Quin

[41:43] Quin gives details on the best place to connect with her.

[43:12] Quin shares her parting thoughts to the audience.

Connect with today’s guest:

LinkedIn: https://www.linkedin.com/in/quinsq/

Resources Mentioned & More:

The Culture Map: Breaking Through the Invisible Boundaries of Global Business Hardcover – Illustrated, May 27, 2014 by Erin Meyer (Author)

https://www.amazon.com/Culture-Map-Breaking-Invisible-Boundaries/dp/1610392507

Cha Cha and the Forest of Wisdom: The Art of Wealth Management Paperback – January 1, 2018 by Elizabeth Verdick (Author) and Quin SQ Thong

https://www.amazon.com/Cha-Forest-Wisdom-Wealth-Management/dp/0199402949

Ana by Karma: https://www.anabykarma.com/

Free Excel Course: Excel Fundamentals eLearning

Picture of Quin training the Bhutan team in the importance of foreign exchange using vegetables & a world map

Pictures of the scarves being made

Complete transcript:

#340: Facts Tell, Stories Sell with Quin SQ Thong

[00:00:29]Hi everyone. And welcome to this week, strength in the numbers and another guest mentor interview, and this week’s guest mentor. Absolutely inspiring delighted to share her with you. Her name is Quin SC thong

[00:00:40]and Quin has worked and led many finance as well as non-finance teams on multiple continents. And outside of our finance profession, that’s actually leverage our skills to develop an amazing social enterprise award-winning social enterprise,

[00:00:54]And the great thing about this interviews is Quin is so easy to talk with. We have a great time together on air and off-air. But what you might find very relevant from our conversation is a few key areas. First stop guess Quin’s got a massive focus on learning and we deconstruct what we mean by strategic learning and the importance of expanding our skill sets as accountants.

[00:01:18] So just not resting on our laurels, particularly if we want to remain relevant and deliver an impact. In our work, whether in our organizations or outside

[00:01:27]We were also really fortunate to have Quin on the show because we also go into some of the learnings as you transition from being a finance controller type role into a finance leader and an organizational leader, having responsibility for the entire company, and then having to do that all again in a different continent.

[00:01:46]A particular area of Quin’s experiences that is, is really awesome is how she shares some really cool stories about setting up an amazing social enterprise in Butan. Empowering local villagers and craftspeople. It’s an earn an income and supply their produce globally.

[00:02:06]So Quin shares some fantastic learnings on how to go about developing such an awesome social enterprise, putting our skills, our finance skills to use there. And then we had some very fun conversations about various frameworks that we use in helping us to accomplish. Our goals and not only our current roles, but beyond it to the future as well.

[00:02:27]So look, hope you enjoyed this conversation and getting to know Quin as much as I did.

[00:02:32]You could definitely show your appreciation by subscribing to our show and recommending us to your friends and colleagues. We’re on all the major platforms, iTunes, Stitcher, SoundCloud, YouTube, Spotify, and Amazon music.

[00:02:44] And if you wanted to find out more about Quin detailed, timesome showing us transcripts and more, you can find that at sitnshow.com. I guess I said offer me for now. So without further ado, over to Quin and the show. Quin, welcome to the show.

[00:03:03]Quin: [00:03:03] Hi, Andrew.

[00:03:05]Andrew: [00:03:05] Hey, look, it’s a pleasure to have you with us. And again, I’ve got to try and be respectful of your time because the last time we spoke, we were speaking for ages. We got to really know each other, but I’d love to share some of you with our audience.

[00:03:16] And before we get into all of that, would you maybe mind sharing with them the story about how you went from being an accountant to the extraordinary career and all the great things you’ve done that you’d love to share with them.

[00:03:29] Quin: [00:03:29] All right. I try to start at a place where that starts. So I was actually a fine student. In fact, going into medical school, we call it pre-med. Back in the days, I was in Malaysia, and then there was an opportunity to join these Big Four’s vacation trainees. I thought, why not. They pay a grant, 100 US dollars a month. This obviously a long time ago, but anyway, to me, it was a lot of money as a college student. So I joined them and I really liked accounting so I stayed on with one of the Big Fours and work with them and go to my qualification as a CPA. And I was quite young at the time, maybe like 20 ish.

[00:04:11] And at that time I said, okay, I better plan this because I was planning to be a doctor. Remember just a couple of months before that. And then suddenly I took on a very different career, which I really like. And I look at it and I said, okay, the highest point in this career, and this is a long time ago, was like Head of Accounting. Back then, there was no CFO or Finance Director roles so long ago. And I thought, okay, that’s what I want to be in 10 years time when I’m like 30. So what I did was I plan to study and qualify. I also plan to learn some skill sets that I need to take with me. I have no idea at that time what it is, but I figured out the firm will provide sure enough tax and all those things.

[00:04:57] And when you stay focused, this is the beauty of being focused. By the time I was 27 or 28, not only have qualified, I was also offered a job to be at Tatangco Financial Control, has changed to a nicer name. So head of finance of a multinational company. So I was really pleased with myself. By then the roles like finance directors or CFOs have also come out in the horizon. These are the big shot names and I also wanted that. And I did get that in my early thirties when I moved over to Hong Kong. And this when I thought, is this it? Honestly, Andrew, I know you are finance person yourself, when you reach what you have worked so hard for and you’re like, is this it? And I also.

[00:05:38] Andrew: [00:05:38] It’s a bit of an anticlimax, right?

[00:05:40] Quin: [00:05:40] Yeah. I’m also a little bit lost for a couple of years. I enjoyed the job, I enjoyed everything. And then I also found one thing. I found that I was not so good at presentation. I think we covered that, right? We were talking earlier, right? Before these town hall things, there were like only a hundred of our staff and I was there presenting the numbers for the year for the first time. And I was so scared. My heart was beating out my chest. My knees were knocking. And I remembered I was just looking at my own PowerPoint on the wall, with my back face towards the audience. That is my start as a CFO.

[00:06:16]We’ll talk about skillsets later and of course I made sure that I have to expand my skillset. It’s not just being good at tax, at finance, at debit and credit, but presentation skills, for example. You’re not only present to your own people, your own company, but you present to the board, you present to your clients. You’re part of a pitching team and you’ve got to look and act the part.

[00:06:41]Skill set, number one. Got to do something about it. And the other thing, I found I could not ask good questions. All I knew how to ask was, I don’t know about any other accountants listening to this, but my questions in the past was just one of these two, one is, could you do it by when and when. The answer should be yes.

[00:07:02] Andrew: [00:07:02] Yeah, of course.

[00:07:03] Quin: [00:07:03] If the answer is no, then I have a follow up question. It’s, why? You can tell that I’m not a very good manager either. So I learned that we have to expand our questioning skills from close ended question to open and that paraphrasing all these fantastic things.

[00:07:21] So I’ve got more to share on this, but the thing about this is once I expand my other skillsets, the opportunities to become Chief Operating Officer of the region. And now I’m the Managing Director of a global trading company in London. So I feel that as accountants, we can go as far as we want to. However, we’re held behind by maybe some skillsets that we should accomplish.

[00:07:46]Andrew: [00:07:46] It’s interesting because when you were starting towards your CPA, a great qualification, we’ve many CPAs listening. And to go from there, to realizing I need to do something about my presentation skills, which if I wasn’t to know that I wouldn’t have guessed that you needed to enhance your presentation skills, I would have just assumed you’re always like that. Always a great presenter and asking great questions as well from our previous conversations. I just sensed that, Quin, that takes me by surprise. So did someone point that out to you? Did you recognize this yourself? How did you first identify that? And what sort of things did you start doing differently that allowed you to be open to learning these new skills?

[00:08:24] Quin: [00:08:24] So if I take a step back when I was like the accountant or finance manager, financial controller, that type, basically I just have to work really hard on the worksheets and that’s something I’m really good at. So didn’t feel any stress doing it. Just long hours and analyzing things. So excited. And you just sit next to your boss and you tell him.

[00:08:42]Andrew: [00:08:42] Yeah.

[00:08:43] Quin: [00:08:43] That’s easy. That’s when I became finance director and it was also quite easy. Except one time the town hall, I remember I was asked by my boss together with the other department heads like the IT and so on and so forth to follow up after him to present.

[00:09:00] Of course I presented the numbers and things. I worked the whole night until 3 AM. I needed my PowerPoint to be perfect because the PowerPoint did all the talking for me. I was just reading it. I thought, okay, I can read this. But I found that when I stood up in front of the hundred people that I know, I’ve been working there like a few years, I was feeling so terrible. Like I said, really in my heart was, my ears with turning. My face was turning. I thought I’m going to die of a heart attack. And I thought this cannot be right. How can it be? That was a one point of my life. I felt I got to do something about this. I cannot feel this bad each time I have to present. Well once a year but that would be enough.

[00:09:43] Andrew: [00:09:43] Yeah.

[00:09:44] Quin: [00:09:44] If you don’t like it. The are three things I really disliked. First is parking. You live Hong Kong, you never want to park your car. It’s difficult. Second is driving. It’s equally hard to drive a car in Hong Kong. The roads are tight and buses are big.

[00:10:00] And the third is presentation. I say, when I live in Hong Kong, I don’t have any of these three because I take the bus and the Metro and I overcome my presentation.

[00:10:09] Now let’s talk about presentation. So I hired a coach and I said, please teach me how to present. And I remember his saying, it was so good.

[00:10:20] He said, first of all, I want you to know that you graduate the day you do not need a presentation slide standing behind you. And I look at him horrified.

[00:10:31] Andrew: [00:10:31] Yeah. What do you mean by that?

[00:10:33] Quin: [00:10:33] What do you mean no PowerPoint?

[00:10:35] Andrew: [00:10:35] I’m paying you to help me be a better presenter. Right? And no PowerPoint?

[00:10:38]Quin: [00:10:38] Yeah. Part of it was like, help me do these PowerPoints.

[00:10:42] Andrew: [00:10:42] Exactly. Do you have any PowerPoint tips?

[00:10:45] Quin: [00:10:45] Yeah, exactly. How do you make the PowerPoint look nicer?

[00:10:49] Anyway, he said, when the day you can present without a PowerPoint and then you put blank slides in, that’s when you are good presenter. As long as you need your PowerPoint, you’re not as good. At that point I was thinking like, you’re almost asking me to stand naked in front of my audience presenting. That’s how it feels without the PowerPoint.

[00:11:09] Andrew: [00:11:09] Yeah, exactly. Yeah. Yeah.

[00:11:11] Quin: [00:11:11] So we practice so we have two slides and we have a blank slide. And the blank slide is when I tell a story. And I found out for the first time. So I have two slides, maybe, like financial performance or whatever. And then I have a blank slide where I tell a story.

[00:11:26] Of course I have to prep for my story. For example, the story, in this world, there are three types of people. And then he say pause and I have two pause. The pause is the second hardest thing. Andrew, you pause. You’re like, Whoa no, but anyway, pause. And then you can see that heightened curiosity. They’re interested.

[00:11:45] And then okay I said, the first type is, pause. And so even pausing I have to learn. Okay? And so the first type is people who make things happen. People like you Andrew who make lots of podcasts, reach out to lots of people. People like you. The second type is, pause. And then some will start to fill in for you. Right. And the second type is people who watch things happen. Let me see. The last type is, and then I pause even longer.

[00:12:21] Andrew: [00:12:21] Very good. You got them on the edge there.

[00:12:23] Quin: [00:12:23] Yeah. And they really want to know and say people who do not know what happens. And from that little exercise I did, the black slide I was telling, Oh, this also the story, it was engaging.

[00:12:34] And I felt wow, it’s so different when you have no busy PowerPoint behind you. You’re talking to them. You’re engaging them like on a one-on-one. And that’s when I find the power of good presentation. You can do that in pitches. You can do this in town hall. And imagine as an accountant, we have so much facts in our hands.

[00:12:55] Andrew: [00:12:55] So many.

[00:12:56] Quin: [00:12:56] Important ones. Ones that you want. Let’s say if you’re board, you want them to buy into decisions. So the one way is to engage them. So all of these pausing allows them to digest what you’ve just said and participate. So I now love presentation. I prepare not what’s on my PowerPoint, but I prepare how to engage and get the buy-in that we need as accountants.

[00:13:23]Yeah.

[00:13:24] Andrew: [00:13:24] Yeah, that’s really great advice. You’re the first person to actually deconstruct that for us, Quin, Prior to doing the podcast and myself, we’re just trying to get attention. So you put the headlines with the shows and the first two lines are key. And actually that one, you said, like there’s three types of people, that’s a great way of starting a conversation because like people want to know what are the three types.

[00:13:43] Most people are curious types. They want to know, okay, what are the three types of people, and where do I fit into those categories? I’ve had explained to me the two types of people, there’s the people that get it and, the pause is key. The pause is the key. And the people who don’t get it.

[00:13:56] It’s yeah. So anyway that’s a really good lesson. I know. I appreciate you sharing that Quin. In your current work, presentation skills are key. But that transition from finance leader to COO, to MD managing director, moving between different countries, different continents even. Is there any sort of particular learnings or advice you could share with our audience looking to do similar themselves, move from a finance role to more of a broader, a COO or MD role or moving between continents.

[00:14:25]Quin: [00:14:25] Let’s tackle one at a time. I think moving between different roles. I must say I didn’t prepare for this. I must say that I was preparing for a role in finance. I really love finance. I see the power of information on their hand. Do not disregard that it’s so powerful and the power that lies in us when we can help make better decisions together with the board or department heads, whoever are in your team to help you make better decisions for the company.

[00:14:54] So as long as we continue in this role using finance numbers, I feel that the world is our oyster. You can go into any role you want in the company. I’m talking about COO, MD maybe even HR, because in our biggest resources is people. They cost us the most. Most of the professional firms, at least 65% to 80% of the cost is people cost.

[00:15:23] Why should an accountant be in charge? Now I’ll counter argue that. An accountant should not be in charge if all you care is numbers. So here’s another story. Now, 20 years ago I was very accountant and I was very happy to be the accountant. And one day the boss say I’d like you to take up HR with me. I looked at him like what does this really mean.

[00:15:48] Andrew: [00:15:48] Where’d that come from? Yeah.

[00:15:50] Quin: [00:15:50] Yeah. It’s like asking me to build a rocket or some space ship.

[00:15:54] Andrew: [00:15:54] Right?

[00:15:55]Quin: [00:15:55] But I recovered quickly and well I like to keep my job, I say to you okay, what we could do is, boss you take the soft bits, I take the hard bits. And that I mean by, I take care of the tax, the payroll, the policies, all things accountants are good at.

[00:16:10]Andrew: [00:16:10] And I’m just good to cross over there.

[00:16:12] Quin: [00:16:12] And you do all the grievances and all the other things, whatever they are. Too difficult for me.

[00:16:17] And no matter what happens, they don’t care because then very soon after there were people coming to my office to seek advice. So they speak, say my PA back then we still have PAs. Also the the assistant sits that out. My office looks like the doctor’s hall. People have to sit on little stools waiting for their consultation.

[00:16:36]Andrew: [00:16:36] Did you have magazines or anything like that?

[00:16:38]Quin: [00:16:38] Oh, I should have.

[00:16:39] Andrew: [00:16:39] To pass the time?

[00:16:41] Quin: [00:16:41] I didn’t. Accounting magazines.

[00:16:44]So anyway, I was distressed because these people came into my room. They didn’t ask. So what is the tax rate in Ireland? And I’ll say X percent. Tell me how much is it? I don’t even know.

[00:16:56] Andrew: [00:16:56] Oh, at 12 and a half corporation tax rate now but the personal taxpayer is. Yeah, we paid 52% personal tax here.

[00:17:02] Quin: [00:17:02] Oh my goodness.

[00:17:03] Andrew: [00:17:03] Right? Yeah. I know.

[00:17:04] Quin: [00:17:04] You learn something every day. Okay. So we say 12 and a half and off you go and then another one comes. So what is the personal tax rate?

[00:17:12] Andrew: [00:17:12] Oh, here at 52%.

[00:17:15] Quin: [00:17:15] Poof off you go. I was so used to being Miss know-it-all in the office. And suddenly these people come to also say Andrew, I have this person sitting next to me. And then you look like, and? And even when they finished the entire story, I’m still looking at them blank like I don’t have the answer. And remember at that time, I don’t have the skillset to even ask questions. So I sit there dumbfounded. Okay, what do I do now? Oh, I’m looking like a fool here.

[00:17:48] And that’s when I took up coaching to learn how to ask quality questions. And along the way, when I learned how to ask good questions and I’ll ask. Okay, I hear what you say. And I repeat some of the key points and then say, what do you plan to do? Simple question. And they tell you. And so I find that the people come to me, they’re not asking me to be the expert, but they’re asking me for permission to share their solutions.

[00:18:20] Andrew: [00:18:20] Interesting. Yeah. I, don’t want to stereotype all our listeners here. But I do find the ones, I get it could be at any role in business, but the ones that make the best transition from finance professional to finance leader or any leadership role is just a holding back a bit from offering the solution themselves.

[00:18:38] Quin: [00:18:38] We couldn’t help it.

[00:18:39] Andrew: [00:18:39] First my people. Yeah. We’re very good at connecting dots and we’re very curious and we’d like to be right and we have loads of good answers to things. Why wouldn’t our solution be useful? Quin, the amount of times I’ve put my foot in it just by blurting out the solution.

[00:18:51]And I thought it was a brilliant solution, but that’s not what people want. They want people to hear out their solution. And I think that’s a key value add. If we can just hold ourselves back a bit and just listen and just let people give us their solution and to ask intelligent questions, to try and even make it better.

[00:19:06] That’s what people are looking for because they recognize this person is smart. Support them. Yeah. How can we go make it happen together?

[00:19:12] Quin: [00:19:12] Yeah. Exactly. And so I remember that after the first week I was the HR of everything. I make a joke to my PA. I said, for years I just have to bring my brains and my calculator to work and I’ve nailed it. I seriously can, most of us can. But then for that week I have to bring my heart and my ears to work.

[00:19:33] And even then I was struggling. So there were more of me at work and I was so tired. I go home I’m exhausted.

[00:19:39]Andrew: [00:19:39] Yeah, no, I can honestly say that’s like the toughest bit of being a leader. Actually supposed to be enjoyable, but I think it’s actually much harder work.

[00:19:45] Quin: [00:19:45] It is.

[00:19:46]Andrew: [00:19:46] Numbers are so easy compared to it.

[00:19:48] Quin: [00:19:48] So coming back to the point about from accountant to real manager of a business or a big business when I was COO, we were in 18 cities across Taiwan, Hong Kong, Macau, China, and Korea. And even my direct staff, I have like about 250 of us. And indirect, we have 4,000, so there’s lots of listening to do, especially when you’re right at the top. People want to come and talk to you. So the point is that we have to be there for them. And what I found that you also give them a framework, so they just don’t come to your office and then we’ll come out with everything and then you go and pick things.

[00:20:27]No. It was too hard. So you also coach them, you give them a framework like the way, accountants, if you have an investment, I give you an investment appraisal template, you fill it out. We don’t have to do that, but really when they come, they know that they can tell me the problem.

[00:20:42] They can tell me kind of the solution they have their mind and perhaps the cost, the timeline or something and where they’re going to find the money to fund this. So the more they can connect these dots in the framework, the more that we get through quickly in one meeting. So they learn to work with you.

[00:20:59]These are some tips for us accountants. If we want to be at this level, to be managers, to let ideas bubble up and put it into a project. We have to help them. And it looks like magic.

[00:21:12] Andrew: [00:21:12] Yeah, I loved your point on frameworks as well. It is having those reference points. Again, like if you think investment appraisals or financial statements, everything’s got a place. So if you can show people like we were showing how to do financial statements and investment appraisals, but maybe help them with their problems as opposed to investment appraisals.

[00:21:30]It’s a similar principle. There’s a framework to walk through, whether what’s the goal you’re trying to achieve here, or what’s the current reality, or the options we need to pick. And, do you need any resources or anything to get you going? They’re great questions. They go through that framework and then, they’re off and running and you’ve made the most of each of your time.

[00:21:45]What a great tip, Quin.

[00:21:46] Quin: [00:21:46] Yes. So everybody can be MDs.

[00:21:48] Andrew: [00:21:48] Yeah that is going to be the challenge because as people go up and up organizations, there’s only like a handful of people at the top, but I do see finance professionals as being finance leaders.

[00:21:58] Maybe not without the title of an MD or a COO or whatever. We can demonstrate leadership in different ways. You know, and very valuable.

[00:22:06] Quin: [00:22:06] And we do .Sometimes we might not get the title maybe for years and I didn’t get the title, but we are equipping ourselves in this manner. So when the opportunity arise, luckily for me it did, then it’s not difficult to transition over because we already have those skillsets that when we are finance partners to our CEO.

[00:22:25]Andrew: [00:22:25] That’s it’s just preparing the ground. And there’s an expression you shared with me previously about strategic learning. All right. And actually, you mentioned this word earlier in our podcast, it is focus.

[00:22:36]Is that what strategic learning is about it? It’s having the right folks and the right things or is it the right plans? How do you feel this strategic learning? Why is that important to you?

[00:22:44] Quin: [00:22:44] So they probably, I’m just making all this up as I go ahead and I’ll go along with you. Okay. I think.

[00:22:49] Andrew: [00:22:49] That’s my secret got out the bottle as well. That’s the two of us.

[00:22:52]Quin: [00:22:52] One is like niche learning. Like when we are learning to be accountants, it’s very niche, it’s very sharp and we’ve got to learn all the consolidation, whatever it right. Then there is broad-based learning. You learn everything because it’s so fun and the internet is always there and they’re like, I don’t know, Udemy and it’s so many things interesting.

[00:23:10] Anyway, the only problem is we don’t have so much time for everything. So where I come into a middle ground is strategic learning. So it’s strategic learning. Obviously there’s a strategy and there’s a big vision. So what is it that you want to be? So we come back to the accountant and the kind of talk that we’re having.

[00:23:29] So accountant has a lot of skill set, great skillset. And the MD level, it’s not about you being the top accountant and top salesman. You are, how do you call it, Mr. Everybody, or Ms. Everybody. So for you is how do you engage and connect with everyone? And that needs communication skills, listening skills, different skillsets that probably some accountants may not have, but have to acquire on the way.

[00:23:54] Like me, I mentioned learning how to ask questions. It sounds silly when I say it now, but I had to learn it. I really actually write it in my notebook and I have to remember. One great example is how you make that person feel at ease. So for example, I’m with you and I want to ask you a question.

[00:24:12] So I will say this, Andrew, I would like to ask you a question. Just to prepare you.

[00:24:17] Andrew: [00:24:17] Yeah, see that’s a really good one. Actually you just reminded me of something today about writing these good questions down. That’s how we’ve tended to do things. Like I will write a checklist. So have we asked all these questions, but just that first point of connecting with people and asking people, can I ask you a question or do I have your permission just to ask a few questions. Puts people at ease. It gives them some of the power back. Giving you a sense of authority, and involvement in the process. It’s great. That was missing off our checklist. That’s going in now.

[00:24:43] Quin: [00:24:43] Yeah. Yes.

[00:24:44] Andrew: [00:24:44] Create an environment where people feel at ease. Yes.

[00:24:46] Quin: [00:24:46] We as MDs or higher, even as accountants we have a lot of authority. When we show that level of respect, you have people relax a bit and perhaps they become also more creative and more open when they talk to you. Solutions come this way. So he says this about helping other people be natural with you.

[00:25:04]I have to learn this. Not that I am an unnatural, it’s just that, as accountants, we are always short of time. We go bum bum, bum, bum bum. I’ve question. Oh, you go.

[00:25:13] Andrew: [00:25:13] Yeah. And I know the team has a shorter time as accounting and finance. Definitely not.

[00:25:17] Quin: [00:25:17] Oh, debit or credit.

[00:25:19] Andrew: [00:25:19] We definitely feel like it. Yeah, exactly. I know we spoke a lot about career, but there’s some fantastic work you do, which I think is extraordinary and I’d love to share it with our audience.

[00:25:26]Just a small bit of work. You started in Bhutan around, actually I’m not even going to spoil it for our audience. Do you want to take us through that? Because I’d be really love to share that with our audience and things that we can achieve in our roles and outside of our roles.

[00:25:37] Quin: [00:25:37] Okay. It’s another little story. So I went on holiday and this was like back in 2014, I went on holiday to Bhutan. So Bhutan is where Kate Middleton and Prince William, when in, I think 2016 and created such a big news over there. So Bhutan is a small Himalayan kingdom and the people still wear their traditional clothes that they wore thousands of years ago.

[00:25:58] So if you go fly to Bhutan, not only is this a mountainous country, it’s also, when you go down there all the men wear skirts as do the women just longer. And you feel like you’ve gone backwards 500 years. It’s like a different world. There I went on a holiday and I met one woman who is an village housewife, and she could make beautiful things with her hands. She weave the cloth. I was thinking, if I could help her, I like to buy her sewing machine so that she could cut the cloth up and make into like little handbags or whatever, because people like me and probably you, do not buy cloth. We buy ready-made products.

[00:26:38] Andrew: [00:26:38] The outcomes.

[00:26:38] Quin: [00:26:38] Yeah. So what do I do with a piece of cloth anyway? So I, and that’s how it started. She didn’t want my money and I thought, okay. I say, how about, of course she didn’t understand any of this in English. It was translated through my driver. I said, how about you make me a few scarves and I will sell it for you.

[00:26:58] Now I’ll be very honest here. I’ve been very honest in my TED talks about this as well. I wasn’t thinking about selling anything. It was just a dignified way of giving her money for the sewing machine. However, she really made really beautiful scarves. In fact, so colorful and beautiful, I call it a Weaving Rainbows in the Himalayas as one of my books dedicated to the weavers.

[00:27:20] So I took it, the eight scarves she made for me, I put it on my bed in the hotel and took a photo. If I knew ANA by Karma, that’s the name of the social enterprise, will be so famous today. I would have taken a nicer photo and do justice to my photographic skills. I didn’t know. I just checked, take a photo. And then I model for it. I got the lady to model for it. I put it on my Facebook and I say to my friends on my Facebook, hey guys, you want to crowdfund a sewing machine for this lady. So crowdfunding back in 2014 was like the hot thing to do.

[00:27:54] Andrew: [00:27:54] Yeah, that was hot back then.

[00:27:55]Quin: [00:27:55] It was. So encounters. You see, we got the skillset to move the Earth. We were at a little bit like Winston Churchill . Just on that day, we sold over 40 pieces. I was elated. I’ve never sold so well in my entire life. And I went to this lady. I took her order, US dollars I have. It’s not even a thousand yet, but close to a thousand USD. I put it in her hands and I said to her, please make me 40.

[00:28:21] I can’t remember how many, 40 almost 50 scarves, quickly before I go home.

[00:28:25] Andrew: [00:28:25] Yeah.

[00:28:25] Quin: [00:28:25] And the next thing was, she could not stop crying. And I thought, Uh oh, what did I do now. You are in trouble. And I asked my driver that, can you ask her what’s up? And she said through her tears, I’ve never seen so much money in my entire life. And this is money I earned. And I thought, oh my goodness. All I did was take a lousy photo, put it on my Facebook and my friends all participated. And this woman’s life is changed forever. And this is the story of my accidental social entrepreneurship. And even then I thought, okay, I’ll take the scarves home in my bag, get them out of me. And that’s it.

[00:29:11] And then my friends started to say, I really liked them. Can I have a few more? And I’m like, what, let me see. So I call it the driver and say, could you go to the village and get a few more? And in 16 weeks, not even 16, we saw over a thousand. By then the whole village was working for me. I was panicking.

[00:29:27]Coming from Bhutan they were carrying it on their bags over to Hong Kong and they go to the temple to collect it. This is really underground. And I’ll give money to the monks. Please take it to the village, please. That’s how it started, but again, I think this is where I’m really thankful that we have that discipline and the rigor in our training.

[00:29:46]I quickly wanted to build up systems because we can not run like this. It’s impossible to expect monks to be your carriers of your scarves and your money. And so we started to standardize, we have training programs and today it is what it is because what we learned back in a days as young accountants, we can put it in place.

[00:30:07]Andrew: [00:30:07] You’ve shared the brief story with our audience here. There’s so many more things you did within there. A lot of effort went in, but a lot of application of stuff that we might take for granted. As you said, the standardization of things, that’s what accounting standards are.

[00:30:19] Quin: [00:30:19] I share another funny one.

[00:30:21] Andrew: [00:30:21] Yeah. Go on. Yeah.

[00:30:22]Quin: [00:30:22] The women, because they are really illiterate and they are village housewives, they probably never stepped out of their village. One of the things I needed them to know is we’re running an international business here. This is not a Bhutanese business. So Bhutanese people. These scarves go everywhere in the world and we won awards.

[00:30:39] So I would sit down and do budgeting with them. I would teach them about foreign currency. So I have this session with them. It’s even in a video. I got a war map on the floor and I got cucumbers, chilies and onions from the kitchen. So I put one cucumber in US, the US map, put there. I put 60 over chilies on the Butan map, which is small place so there’s overflowing everywhere and I put eight onions on Hong Kong, but basically what I was telling them is one US dollar, which is cucumber is equivalent to almost eight Hong Kong dollars, which is the eight onions, and 65 or 64 ngultrum. They are local money.

[00:31:21] So that’s how I teach them. And then later we removed the cucumber and we start putting coins and real money. And they’re looking at the different currencies. Japanese notes. And this is how, when we work with people for example, the counters, we are so good with our jargon, but we could be working with the IT person or marketing. And here we are talking about things that only we know what we are talking about, but when it brings things from the kitchen, it was not threatening. It was fun. It was easy. And before they know it, they were playing with real money. This is Monopoly with real money going on there. All I needed them to know is this. I want you to know that in different countries, we have different currencies. You don’t need to remember, is it eight or one or 64. All you need to know that it’s not the same.

[00:32:09] Please ask the question. Because when you don’t know, you don’t know. That’s where the danger is when you know you don’t know. Just ask. That’s where I needed them to be.

[00:32:21]Andrew: [00:32:21] A great example. Also a great question as well. Actually, there’s plenty of things we don’t know we don’t know. And that’s where we get into really big trouble. But when we know that we don’t know, then actually that’s quite powerful. We can do something about that Ask a question.

[00:32:32] Quin: [00:32:32] Especially like in Korea, we are in the world of finance. We are more connected than ever thanks to your podcast. You’ve connected so many people sharing their golden rule advice to us. We can also leverage on this to ask questions to one another. Someone would surely know.

[00:32:47]Andrew: [00:32:47] Yeah and that was the whole premise behind putting the show out. It was just to allow us to scale our knowledge, sharing with each other. It’s like this will always be accessible for anyone interested in finding out social entrepreneurship or how to make the transition between finance or COO or MD roles, Quin. It’s like it’s adding to that heritage. We can share these stories.

[00:33:08] Again, want to be respectful of your time. We could talk for ages like we did last time, so I’d rather be careful here. Well you’ve been giving us some really great advice, Quin, but what’s been the best bit of advice you’ve ever received?

[00:33:20] Quin: [00:33:20] I’ve got many except it was very interesting is one of the podcast guests you have. And when she say she got the advice or thing, that’s the same advice that I got. So if you don’t mind, I’m going to repeat that because it’s so good.

[00:33:35]Andrew: [00:33:35] If it’s so good, it’s worth hearing again, right?

[00:33:37] Quin: [00:33:37] Yes, worth hearing. So I must say at different stages, different advice apply best. At this stage in my life, this one was really good. So the advice is if money could solve the problem, let money solve the problem. So I first heard this from a gentleman who was in Hong Kong, who was very successful in business. He is quite elderly. And it turned out that when I asked your guest, I say, do they know each other because, that was the advice I got, too. Apparently her father who gave her the advice is friends with this gentlemen who gave me the advice.

[00:34:09] Andrew: [00:34:09] It’s such a small world. Isn’t it?

[00:34:12] Quin: [00:34:12] Right? So maybe her father gave this guy the advice and later pass it onto me.

[00:34:16] Andrew: [00:34:16] That is so nuts.

[00:34:17] Quin: [00:34:17] And this is where again, we maybe are no longer in our twenties. Really. I was saving a hundred US dollars. I’m not earning a hundred US dollars anymore. Where if I did, then maybe this advice is not applicable. But we have a little bit to spare, but I still have the mentality. If I could do it myself, I do it myself. So when this gentleman gave me this, I was like, I don’t really like the advice. And it’s also because you have much more money than me. That’s why you can say this.

[00:34:42] Andrew: [00:34:42] Oh God. Yeah.

[00:34:42] Quin: [00:34:42] He said no. He said when you free up your time, let’s say for example, I could get a house cleaner to come and clean my place for 15 pounds an hour. It’s a lot of money. It goes. But at the same time when that person does it, I’m freed up to do other things that I’m better at.

[00:35:03] Yeah. And not only do I get freedom of time to do what I like, but perhaps I’ve got more mind space to think about what I need to think about. So the thing is, we’re talking about maybe two hours at 30 pounds, but there could be other things that’s going on that we are trying to save a bit money, but in the end exhaust our time, which is a very limited resources. Since I started practicing this, I find that I have much more time to think about what I want to think about. When you talk about strategic learning, just now, to spend more time on strategically building up the skillset that I need, whether for my life or for my career, especially in the last 18 months, when I moved to London to work. There are much more things that I need to learn.

[00:35:49]We never stop learning, but where are we going to find a time? So where you can, outsource. We outsource. So this is the saying that we say before. Outsource the doing, keep the thinking.

[00:36:03]Andrew: [00:36:03] You know what, that is the template for future career. Success rewards meaningful work. Whether that’s inside or outside of our finance careers, Quin. There’s so much technology out there that’s low cost, that we can outsource a lot of things to.

[00:36:19] And I would say maybe that’s been embraced in the wrong way in terms of cost cutting. If we do it in terms of freeing up time, are we then developing the right skills to make the most of that time? So that’s why it needs to be strategic. And I encourage our listeners to take that advice to heart.

[00:36:35]I find again into my own journey. You look back it’s like, why am I spending a few minutes haggling over 10 pounds or 20 pounds or whatever. I mortified my son once when we’re getting a new bed, we just bought a house. We didn’t have much money.

[00:36:47] And I hadn’t even qualified at that stage. And I was haggling over 10 quid and my time could’ve been spent better elsewhere. Now I’ve got the 10 quid, but it mortified my son. So that was actually probably worth it because we have that memory. Remember that time when you were absolutely mortified and wanted to get swallowed up by the floor.

[00:37:04]Yeah, so I completely agree with you. I think maybe we should be a bit cue sharp and a bit more aware of how we spend our time. With an eye on the now and the future. So now I like that. I think it’s a great advice.

[00:37:14] Quin: [00:37:14] It is especially for perhaps a people with a number of years in business or career. We have a bit of resources as in financial. So we use that to free up our other resources which is time. Now time is more precious. So after practicing what this gentlemen tell me, I’ve been practicing for a few years. I’m not saying that I take a helicopter to work, right?

[00:37:38]Andrew: [00:37:38] Yeah, we did raise it like yeah, not this time. We more time now, right?

[00:37:42]Quin: [00:37:42] But having said that, where you can, the amount of resources it frees up for us is the brain space, which is so invaluable and the time. And really try it. I have been blessed by this piece of advice. So it was Alice Tang who shared this in the last podcast. And I am grateful to her for reminding me this very good practice.

[00:38:03] Andrew: [00:38:03] Yeah. I love sharing the credit as well. It’s great. Great quality. So thanks again. Now we’ve spoken about a few books in our conversations, Quin. Is there any book you’d recommend our audience or resource you recommend our audience go check out.

[00:38:16] Quin: [00:38:16] So I was just reading this book like practically yesterday and I’ve been traveling around with this book. It’s called The Culture Map. It’s written by American lady who lives in France with her husband and children. And she’s now all into cross-cultural management as we, whether we are accountants or MDs, whatever role we play, even the small role and in the world of Zoom and all this, we tend to work with people from different countries, different culture, whether really like separate countries or you could be sitting in the same place. Like in London, I’m sitting in the same place with so many different ethnicity.

[00:38:53] Andrew: [00:38:53] Oh yeah.

[00:38:54]Quin: [00:38:54] And it’s so important to understand the nuance. We’re always in a hurry to make decisions and we don’t read into things that are there. For example, one of my favorite ones, and quite a few of us have this, for the first time I went to India to present to a group of employees, this great new HR and initiative we have as the COO, the other of them were really shaking their heads. Oh, this is not going well. But then later I find that they’re half nod half shake is actually, yes, I agree. So we will nod up and down. They will go like this. Not really. After a while I got used to it too, because it was good because I was saying, why are they all doing this?

[00:39:34]And I was a little bit, because I told you as a presenter now I really watch people’s reaction. And I try to be more energetic if the energy falls on, I’d be cooler. But then I didn’t know how to react to this. No, I don’t like this. No, I don’t like this. Okay. I’m in trouble here. But no, clearly they were agreeing, but because they were smiling, so I was a little bit confused. But very quickly I learned that. And also little things like when you work with the Japanese they are very systematic. They need to agree at every single point, which is very frustrating. But at the same time, I’ve found that when they do, later when the project goes into action, it’s very smooth. Oh. It’s learning. It’s a lot of learning and this book is really helping me. Only in chapter two and I go, oh no, oh no.

[00:40:18] Andrew: [00:40:18] Just thinking about where I made those mistakes in the past, it was like, Oh my God, I can’t believe why I did that. But look that’s where knowledge is power, and it’s not just knowledge is power. It’s actually putting it into action. That’s how we get more wise and gain wisdom. A great recommendation.

[00:40:32] Quin: [00:40:32] That’s one tip to this culture. For example, now I work in London and I know the Brits, they say it’s quite nice, actually they say is lousy to get out my face. So I actually have to tell them, if it’s not nice, please don’t say it is quite nice because I hear it as it’s quite nice. It’s just the way I am. So sometimes it’s setting this and when they say is quite nice, then I actually sit down and say, is it really quite nice, or you don’t want this because I’m not sure which one you’re talking about. They smile like, oh sorry, Quin,

[00:41:03] Andrew: [00:41:03] yeah,

[00:41:03] Quin: [00:41:03] want it.

[00:41:04] Andrew: [00:41:04] It’s uh, yeah. I think we’re very similar in that regard. We just like people to be clear. Just tell us, we judge you that badly or anything.

[00:41:11] Quin: [00:41:11] The the tip is to, ask a clarifying question. So I’ll just say, if you don’t mind, I need to ask a clarifying question here and I ask and the more I do it, now I’m with them for 18 months they understand that sometimes I may not get what they really want to say to me. And they say, no Quin, for your benefit.

[00:41:26] I always thought, okay, I better listen.

[00:41:29] Andrew: [00:41:29] I liked that. No, that’s good. That’s very respectful in a very good way. A Quin, that’s fantastic. I suppose again, if our audience wish to continue the conversation, where’s the best place to connect with you at?

[00:41:41]Quin: [00:41:41] Ah, it’s a good question.

[00:41:43] Andrew: [00:41:43] LinkedIn. Google.

[00:41:44] Quin: [00:41:44] LinkedIn would be at Quin SQ. So Q U I N and then SQ is actually my Chinese name. So my name is like Su Quin, except that if everybody goes around that, they will be stuck. My name is too long so Quin and SQ and you can find me on LinkedIn now.

[00:42:01] I love to connect with accountants and non-accountants as long as I think. This is such a lovely place even in the face of pandemic now. We all have our different ways of managing this environment, but at the same time, there’s so many more people who are reaching out to help each other.

[00:42:18]And I feel very blessed. So I’m very grateful to have met you as well and have conversations and listen to your other guests on your podcast. And you feel like you’re not really alone.

[00:42:29] Andrew: [00:42:29] You’re not alone. No. It’s so true.

[00:42:30] Quin: [00:42:30] That are out there, so please reach out and I’ll be so happy to meet more people, especially now that I’m working in Europe.

[00:42:37] It’d be great to well, I think you’re talking about 170 countries, right? So I’m looking forward to 170 countires.

[00:42:41] Andrew: [00:42:41] Yeah, 170 at the moment. Yeah. I always do wonder Quin is do people have better things to be doing in some of those countries like there’s wars going on in some of them and some of them they’re like. We’ve got like listeners in Greenland. It’s like , people really find this stuff interesting.

[00:42:57]Understanding what works well, what could work better. People sharing their stories. Helping improve confidence. Straightening the career curve and so on. Oh look, it’s great. It’s really humbling actually. The amount of people who are willing to give back and share their stories and definitely makes it much easier for the rest of us.

[00:43:13] Quin: [00:43:13] Yes, definitely. And I just want to say that we, there’s a Chinese word called a crisis, so it’s made up of two words. I’ll just say in Cantonese. Ngai gei. So ngai means danger. Gei means opportunity. So what it means is when there’s danger, there’s always opportunity behind it.

[00:43:35] So we are in dangerous times in many ways. Yeah. Jobs affected.

[00:43:40] Andrew: [00:43:40] Oh yeah. Yeah.

[00:43:41] Quin: [00:43:41] Families cannot meet each other, so on and so forth. It’s not a nice time to be in, but at the same time, do not waste this danger. Like a Winston Churchill say, look for the opportunity behind it. And there are lots, and this is where I keep myself motivated, by looking for the opportunity.

[00:44:01] And again, thank you for having me on this podcast and thank you for introducing me to SITN so that I could listen to other great people as well. This is certainly an opportunity that I didn’t see coming.

[00:44:12] Andrew: [00:44:12] Oh, I love that. What a great way to wrap up on those parting thoughts, Quin. Thank you so much for investing your time with us today and being such a great mentor on Strength in the Numbers. Thank you so much.

[00:44:21] Quin: [00:44:21] Thank you as well. It’s my pleasure to be here with you, Andrew, and all your audience. Thank you so much.

[00:44:29]

[00:45:59]