Adjusting incentives

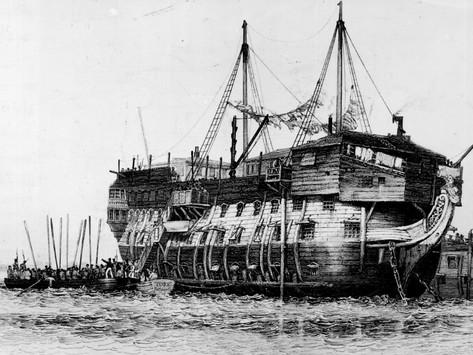

It’s reported that sailing under this incentive system led to high mortality rates with one ship losing nearly one third of its prisoners. So with your Finance hat on how would you have adjusted this reward system?

Well the answer depends on what behaviour would you like to encourage.

In this instance Irish & English authorities modified their payments to ship captains with the aim to prevent the high-level of prisoner expiration and improve their survival rate. Instead of making a one-off payment per prisoner who got on the boat, the financial incentives were changed so that a portion of the total payment was withheld and only paid for each prisoner that got off the boat alive and well in Australia.

The impact was that the first 3 ships sailing under the new approach experienced only 2 deaths out of 322 prisoners, and the new incentive system kept mortality rates low and insured the prior gross abuses were almost entirely limited

And this example plays out in our organisations each day in all parts of the value chain. As much as it would be nice to think that people will be motivated by duty, compassion or loyalty, to do the right thing, there are a lot of instances where people will respond better to specific incentives and self-interest.

Now I’m not saying that incentives need always be financial as in our prison ship example however the point is that incentives are important in aligning the interests of the all parties in a value chain whether these be customers, suppliers, investors, employees, distributors, agents, governments and communities. And if we as finance professionals can properly align the overall incentives of these constituents we greatly improve our ability to help our organisations succeed.

So how to improve incentives?

This isn’t as straight forward as taking something out of a text book, or economics like principal-agent theory, improving incentives requires and understanding of the right value drivers for each part of the value chain and finding these can unfortunately be a tricky and subjective exercise, as what one person values quite highly another group may not. So to be successful at incentive setting the trick is to answer:

How can we make it more profitable for the other person, team, group, etc… to do what we would prefer?

In Finance we can do this by leveraging our broad view of an organisation, our access to data & information, access to decision makers, our training to translate activities into financial outcomes and our perceived integrity to better understand each of their unique operations so that we can determine how to best guide their attention towards the most productive and valued outcomes whilst applying our controllership skills to limit the adverse impacts of any unintended consequences when structuring such incentives.

Such examples can range from us advising leaders to pay sales reps higher commissions on their sales of more profitable or newer products to encourage their marketing with customers, or adopting zero-based budgeting to have managers better justify their business as usual spend levels to free up cash for investment, or even improving compliance with environmental regulations to improve the perception communities and government agencies have of a business.

This doesn’t mean that everyone needs an incentive to do the right thing every time but the proper incentives will ultimately result in both good and not so good people doing the right thing more often and create value for themselves and our organisations. And that’s why we bring on guest mentors to our Strength in the Numbers Show, to share with you their stories and hard won lessons around what incentives they’ve experienced that have worked or not, and they even break their stories down so we can also benefit by putting these into practice and helping their businesses, clients, other departments create more value for their organisations.

Now even with good incentives well-intentioned and motivated people who are eager to succeed will still face a challenge of understanding where and how to focus their time and effort, so in my next article I’ll discuss ways we in finance can help add value to them by providing them with better insights around what steps to take.

So are there any incentives you would recommend? Or how do you know you’re setting the right incentives to create value?

The author Andrew Codd is the producer of the Strength in the Numbers Podcast which interviews real finance practitioners to break down their hard won lessons and deconstruct their practical methods that work on the job and which you won’t typically find in textbooks or exams so that we create more influential finance professionals worldwide who solve meaningful problems for their organisations and in return have fun, rewarding and successful careers in finance.